Internal Repair Orders

Examples of how Internal Repair Orders are accounted for in EverLogic and QuickBooks.

What is an Internal Repair Order?

Internal Repairs are used for reconditioning and / or adding products to units, and may include labor and / or parts. The Internal Repair Order is ‘paid for’ by the dealer and the work is performed at internal labor rates and parts prices. Often the internal work is done at cost, but it can also be marked up, that is up to the dealer.

Some examples of Internal Repairs:

- A used travel trailer that is in poor condition needs to be repaired and reconditioned to make it sellable.

- A satellite dish and washer / dryer are installed in a new motorhome to make it more merchandisable.

- A tow package is included in the purchase of a Fifth Wheel Trailer.

- New tires are needed on a vehicle to make it safe and sellable.

How is it accounted for?

The value of the Internal Repair Order increases the asset value of the unit. In EverLogic, when an Internal RO is closed, the value of the labor and parts is added to the Vehicle Itemized Charges on the unit.

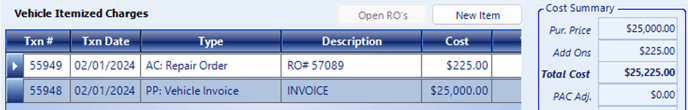

In the screenshot below, an Internal Repair Order with $125 of labor and $100 of parts was closed and added to the Vehicle’s Itemized Charges. The base cost of the unit was $25,000 and with the value of the Internal Repair Order Add-ons added to the unit, the Total Cost equals $25,225. Because the unit is in inventory, the asset value that is carried on the Balance Sheet is $25,225. Conventional thinking by many dealers is the ‘Cost’ of the Internal Repair Order should be expensed at the time the Internal Repair Order is closed. Also, that the transaction should not be posted to the Balance Sheet but expensed as a Cost of Goods Sold on the Profit & Loss Statement. This is incorrect. As previously stated, because the sale of the product has not been executed, and the unit / vehicle is held in inventory, any improvements made to improve the value of the unit / vehicle must also be included in the inventory’s value.

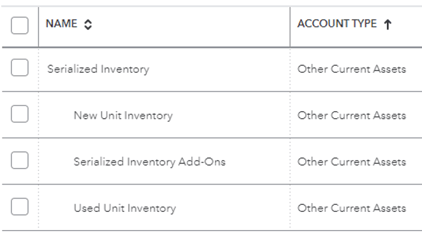

The methodology we employ at EverLogic is to post the value of the Internal Repair Order to an Asset Account. Typically, we separate the inventory’s add-on asset account from the unit / vehicle inventory asset account. However, it would be equally correct if we included the add-on value in the unit / vehicle inventory asset account. Either way, it is accounted for correctly.

The example below shows how a dealer might organize their Chart of Accounts for Serialized Inventory. Synonyms for Serialized include Vehicle, Whole Goods, Unit, etc. In the example, the inventory is broken out into New, Used, and Add-Ons, all are Asset Accounts.

Posting Internal Repair Orders to Accounting

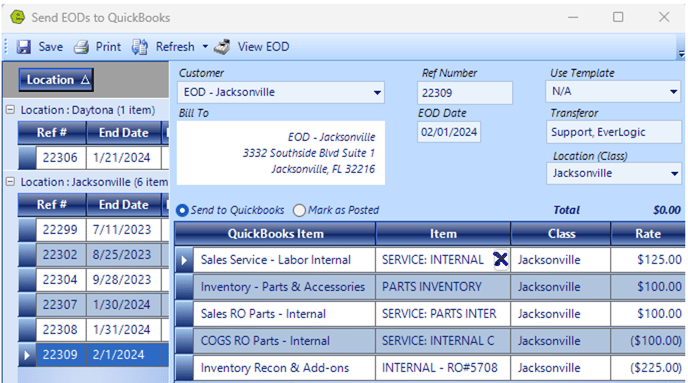

After the Internal Repair Order is closed and the End-Of-Day (EOD) process is ran, the Internal Repair Order is included in the End-Of-Day transaction to be posted to the accounting system. In the example below, only a single Internal Repair Order transaction is included to help illustrate how internals are handled in accounting.

The example above, shows the last line of the transaction posted to the Inventory Recon & Add-ons QuickBooks Item, which is mapped to the Serialized Inventory Add-Ons Asset Account.

Inventory Recon & Add-ons (Product) à Serialized Inventory Add-Ons (Account)

When the End-Of-Day transaction is posted to QuickBooks, the Serialized Inventory Add-Ons Account value increases by $225. Expressed as an equation, where credits + debits = 0, see below:

- Sales RO Parts – Internal $100 (Credit) + Sales Service – Labor Internal $125 (Credit) + Serialized Inventory Add-Ons -$225 (Debit) = $0

- Inventory – Parts & Accessories $100 (Credit) + COGS RO Parts – Internal -$100 (Debit) = $0

In the first equation, the sales of labor and parts are offset by the value of the transaction. This value is carried on the balance sheet in the Serialized Inventory Add-Ons Asset Account. The internal sales are recorded as income on the Profit and Loss Statement. The asset value will be carried on the balance sheet until the unit is sold.

In the second equation, the Inventory – Parts & Accessories Asset Account is reduced by the cost of the parts, and the cost of the parts increases the Cost of Goods Sold Account.

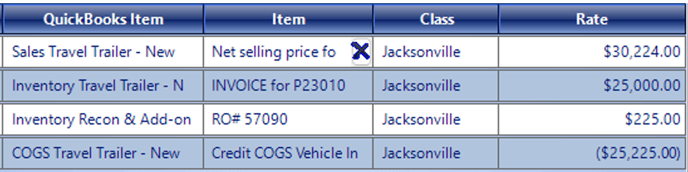

When the unit is sold, the Inventory Recon & Add-ons $225 is credited i.e. removed from the asset account and the cost is added to the cost of the unit and is debited from the Cost of Goods Sold. This cost offsets the internal income, which was recorded when the Internal Repair Order was sent at the End-Of-Day transaction.