Rental Workaround

This article includes some suggestions on how to work with rentals in EverLogic. These are only ideas that have been found helpful as a workaround for rentals in the database.

Possible Rental Inventory

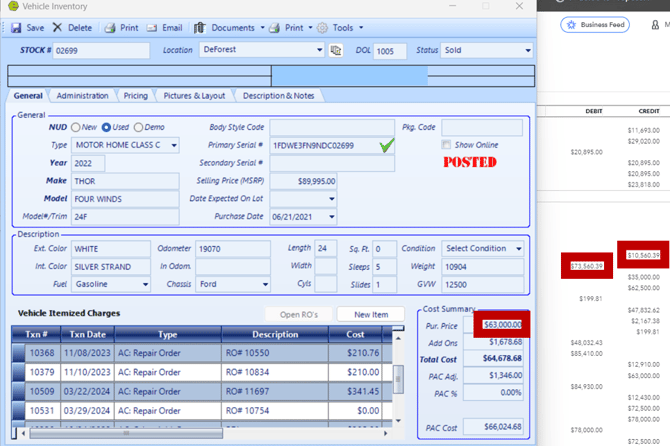

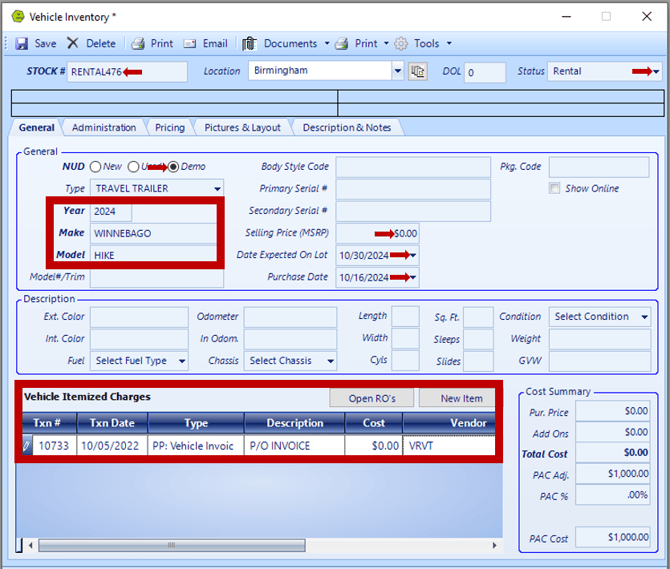

- Stock Number - consider using "Rental" in the Stock Number

- Status - Rental

- NUD - Mark Units as “Demo”

- Year / Make / Model

NOTE: DO NOT post the unit in QuickBooks.

EverLogic does not support fixed assets. The unit will require a depreciation.

Possible Rental Parts Invoice / Repair Order key as much info as possible

- Invoice type = Rentals (setup in QB)

- Repair Order type = Rentals (setup in QB)

IMPORTANT: ALL maintenance repairs MUST be mapped to Rental Expense, instead of COGS.

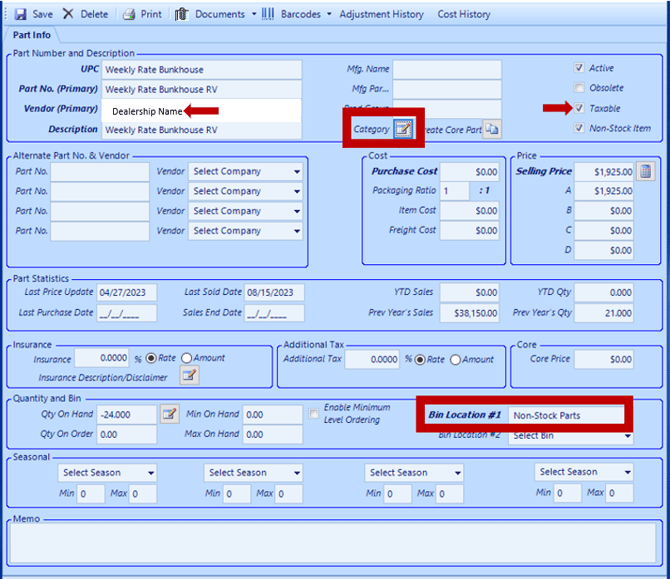

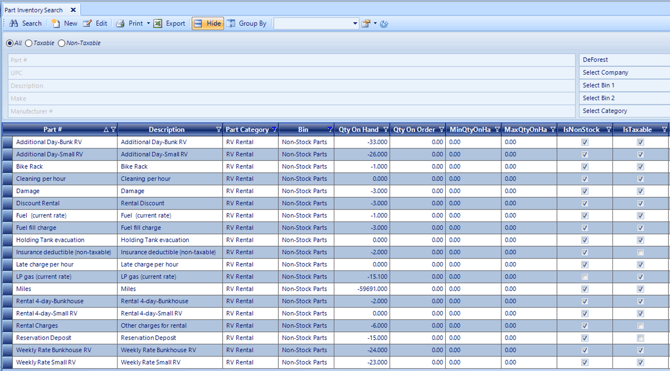

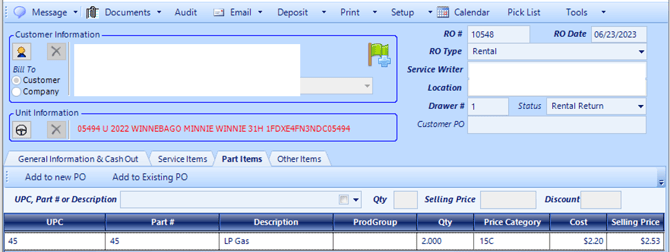

Possible Rental Parts

- Items keyed as “Non-Stock Items” with Category “RV Rental" and add Dealership Name as Vendor

Possible Rental Parts Names

- Daily rates

- Weekly rates

- Additional days

- Rental Discount

- Mileage

- Reservation dep

- Late fee

- LP gas

- Fuel / fueling

- Bike rack

- Holding tank

- Insurance deductible

- Non insurable damage

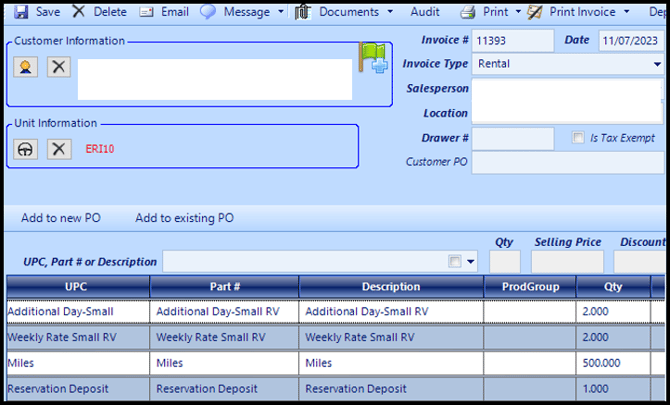

Invoice EXAMPLE

- Take Deposits

- Initial estimate the mileage

- Change mileage upon their return

- Remove part line for reservation deposit, since it is based on estimated mileage

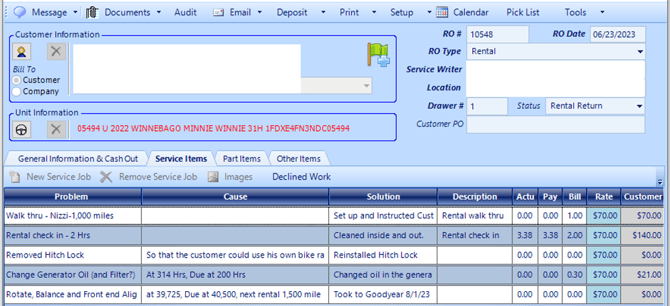

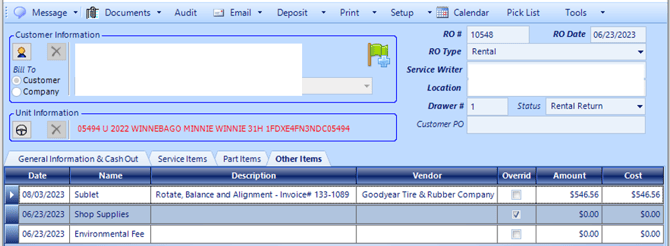

RO EXAMPLE

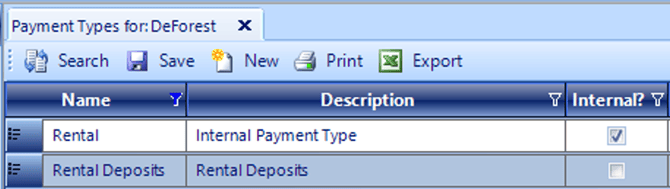

Possible Rental Payment Types

- Rental Internal Payment Type

- Rental Deposits

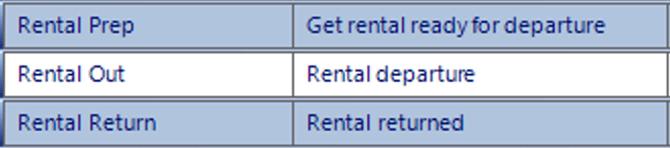

Possible Rental Repair Order Statuses

- Rental Prep

- Rental Out

- Rental Return

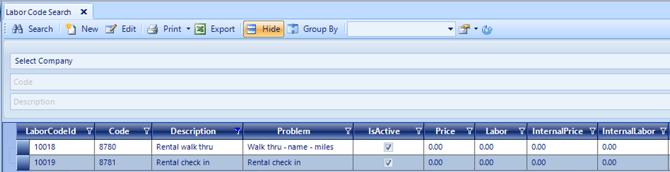

Possible Labor Codes for RO

- Rental walk through upon rental

- Rental check-in upon return

IMPORTANT: ALL maintenance repairs MUST be mapped to Rental Expense, instead of COGS.

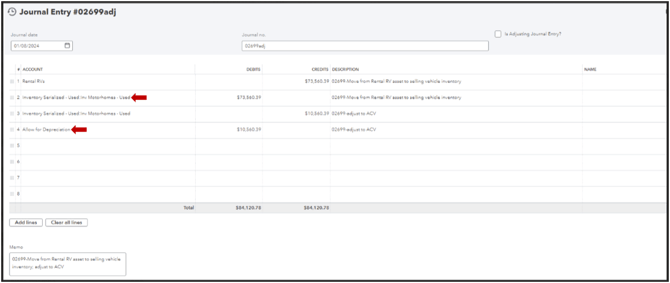

QuickBooks Journal Entry Depreciation

1. Click the New Button

2. Go to the Other Column and select Journal Entry

3. Enter the Line Items, based on the two scenarios below;

- The unit will need to be added to QuickBooks manually. You will do this with the following transactions.

- If the unit has been in inventory and you are simply recording the asset in a new QB file,

- Rental Inventory (Fixed Asset) = Debit

- Accounts Payable = Credit

- Accounts Payable = Debit

- Bank Account = Credit

- If the unit has been in inventory and you are recording the asset in a new QuickBooks file, your journal entry;

- Opening Balance Equity = Debit

- Rental Inventory (Fixed Asset) = Credit

IMPORTANT: Document the VIN, Stock_____, _____Type of unit in the Description Field for each Line Item.

![]()