Gift Certificate Setup and Item Level Mapping

This article is a guide to setup mapping and accounting for gift certificate sales and redemption. This article does not cover gift cards issued via a card processing company.

IMPORTANT: The new QuickBooks Items should be created in QuickBooks first, mapping confirmation will need to be completed; see QuickBooks information at the bottom of this article.

Set-up New Categories and Mapping

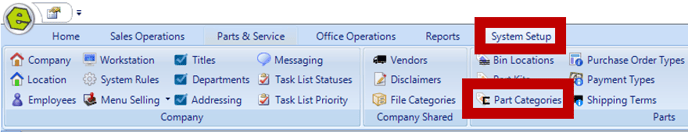

1. Navigate to the System Setup Tab and select Part Categories

2. Click New

3. Key the Name as Gift Certificate

4. Check the Active Box

5. Use the drop-down menus to add

· Type = Other

· Income Item = Sales Gift Certificate

· Disclaimer = leave blank or complete as desired

6. Click OK

7. Save

Create a Payment Type Gift Certificate

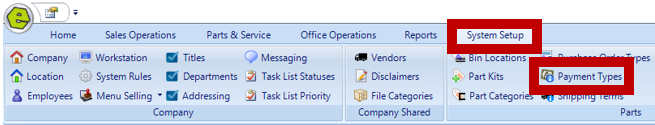

1. Navigate to the System Setup Tab and select Payment Types

2. Click New

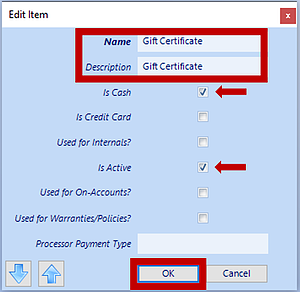

3. Key Name and Description as Gift Certificate

4. Check the Is Cash Box

5. Check the Active Box

6. Click OK

7. Save

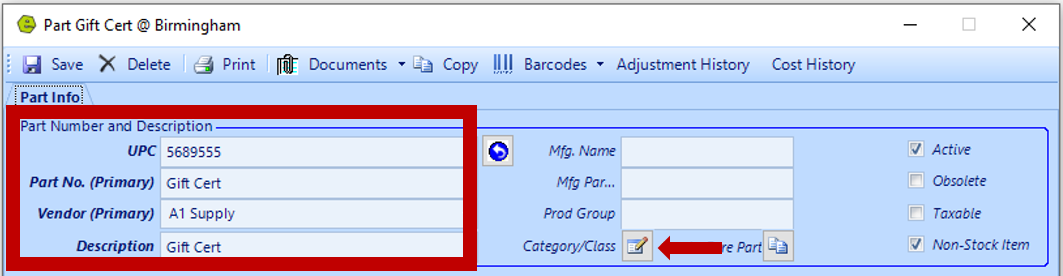

Create New Part for the Gift Certificate

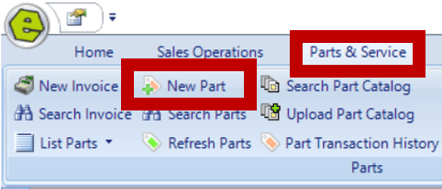

1. Navigate to the Parts & Service Tab and select the New Part Form

2. Complete all the bolded fields, under the Part Number and Description

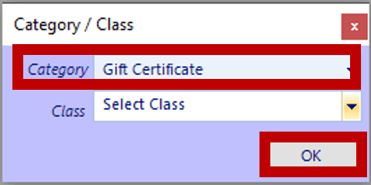

3. Click the Categories/ Class Button

4. Assign a Category created for the Gift Certificate from the drop-down menu

5. Click OK

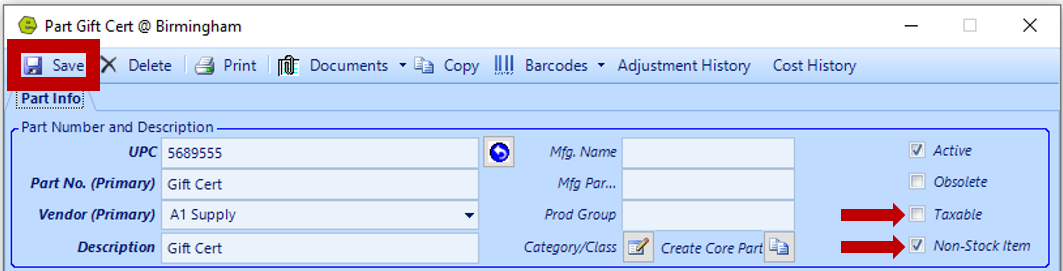

6. Check the Non-Stock Item Box (This will prevent the the Cost Field from being a mandatory field.)

NOTE: The Taxable Box may need to be unchecked, depending on local standards.

5. Save

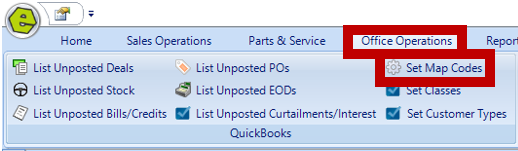

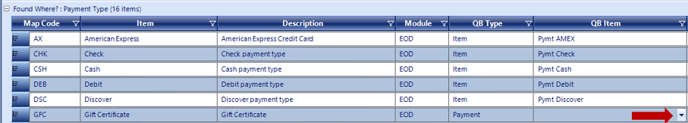

Set QuickBooks Map Codes

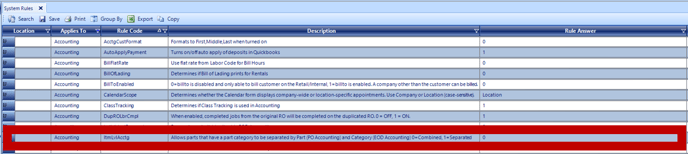

NOTE: The System Rule ItemLvlAcctg will allow Gift Certificates entered as parts to be mapped individually via Part Category Mapping. The Gift Certificate sale and redemption will be separated from Part Sales by Category in the EOD Accounting. The System Rule will need to be set to 1 for accounting functions to use the mapping set in the Part Categories.

1. Navigate the the Office Operations Tab and select Set Map Codes

2. Locate (GFC) Gift Certificate

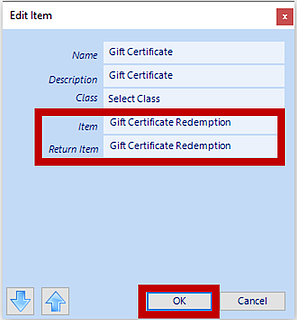

3. Click on the down-drop arrow in the QB Item Column

4. Use down-drop menus to select

· Item = Gift Certificate Redemption

· Return Item = Gift Certificate Redemption

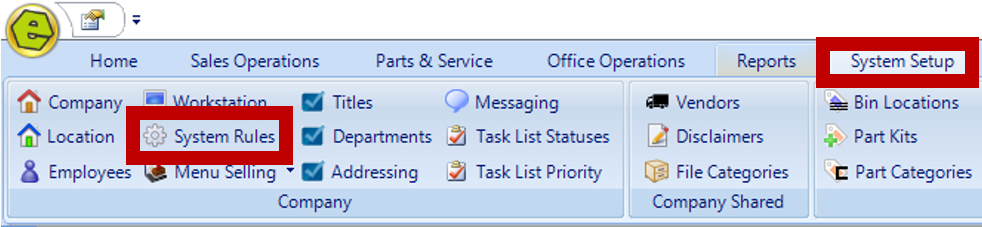

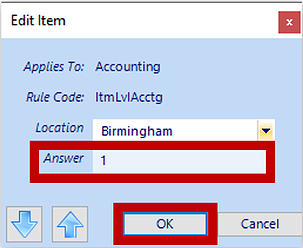

5. Navigate to the System Setup Tab and select System Rules

6. Locate ItemLvlAcctg and double-click to open

7. Key Rule Answer 1

8. Save

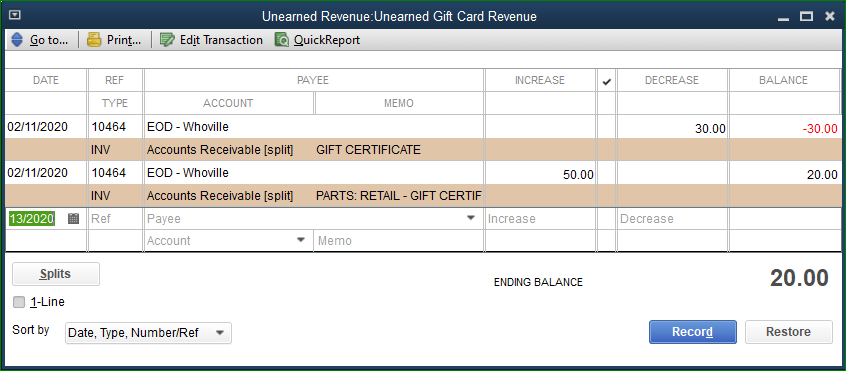

EOD and Accounting

On the End of Day Accounting Window, the sales and payments will use the set mapping.

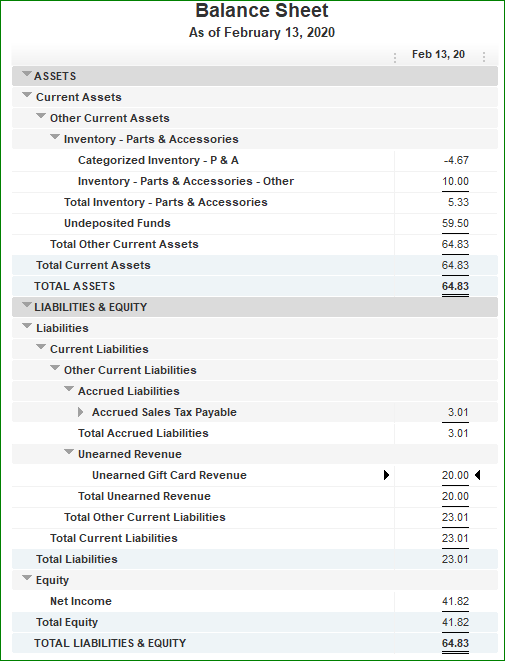

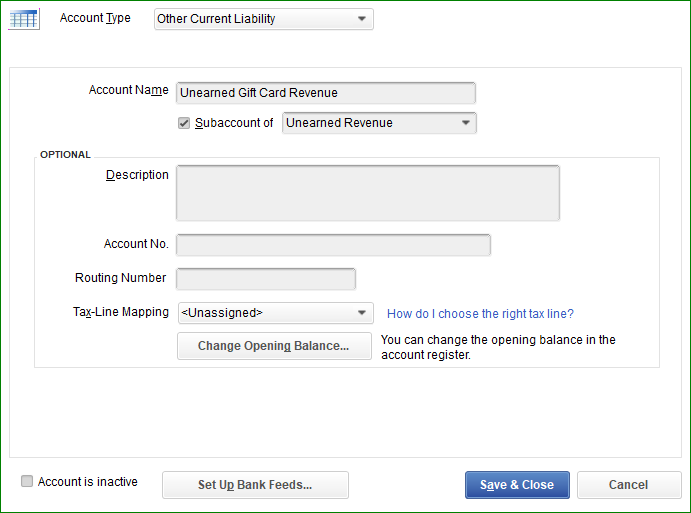

Suggested mapping / item / account set-up

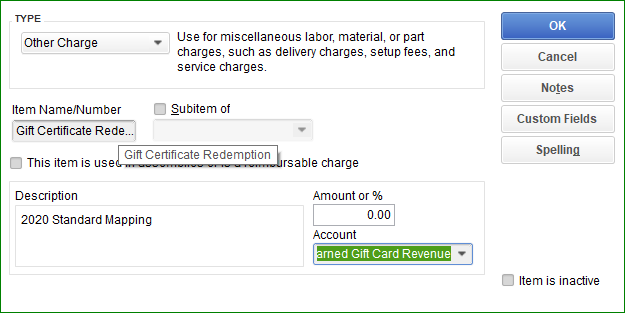

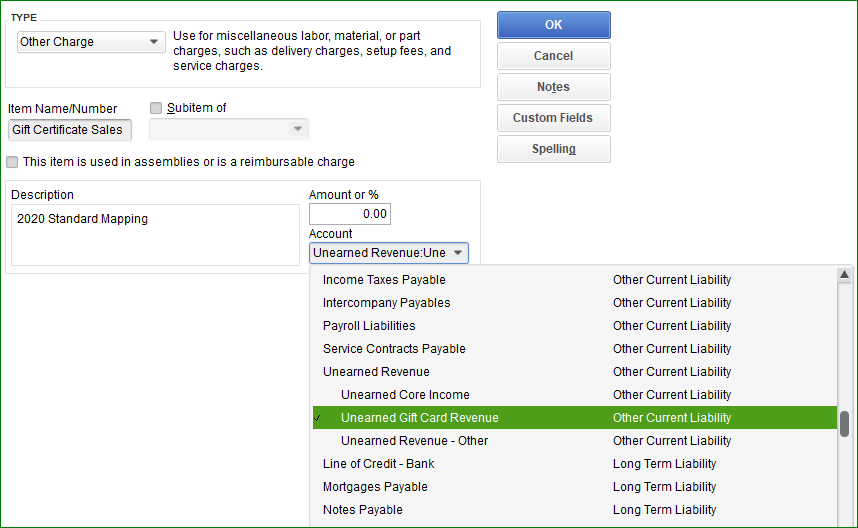

This is the account that Gift Certificates flow through, this account may already be set-up in your Chart of Accounts.

This Item will then be placed in the Payment Type Map Code.

This is the Item that will be placed in the Part Category Mapping.

Related Articles:

Selling / Redeeming Gift Certificates