A deal will be "unwashed" by changing any information on the deal, ie changing the Salesperson, APR or Taxes on the Deal.

There may be times where a change has to be made on a "Washed" Deal. The Deal will automatically be "unwashed", if a change is made to one of the items listed below.

Deal:

-

-

- Changing the Selling Price

- Adding parts or jobs to the write-up tab

- Changing the Salesperson / Sales Manager

- Taxing, removing tax or changing charges on the Item Price Tab

-

-

-

- Adding / removing discounts and / or rebates

-

Repair Orders:

-

-

- Closing an associated Internal Repair Order

-

Unit Inventory:

-

-

- Making changes to the cost of the unit on the Vehicle Inventory Form

-

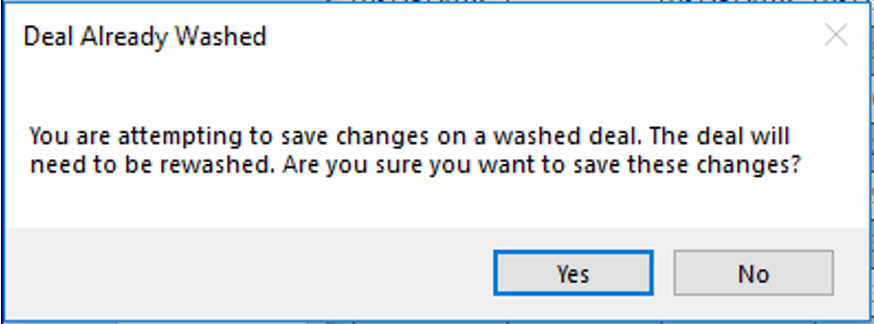

If you click Yes:

1. The "Wash" Stamp will be removed from the Deal Form

2. The deal will be removed from the List Unposted Deals to be sent to QuickBooks.

3. The deal will need to go through the Profit Accounting Process again.

If you click No:

1. Your Wash Sheet will NOT be updated to include the new changes

2. If you wish to include the changes, and you clicked No, you can still rewash the deal, by accessing the View More Menu and select Profit Accounting, then click Wash.

Note: A deal can be washed / rewashed as many times as necessary.

IMPORTANT: If a deal is already posted, you will not be prompted to rewash the deal after making changes. Please speak with you bookkeeper before making any changes to a posted deal.

Related Articles:

Accepting / Refunding a Deposit on a Deal

Cancel Deal "Undo Sale & Restock" Inventory