Dealers use PAC, Protected Against Commission, to ensure they make money on every vehicle they sell. The funds are used to account for the vehicle expenses, prior to the sale; ie insurance, advertising, etc.

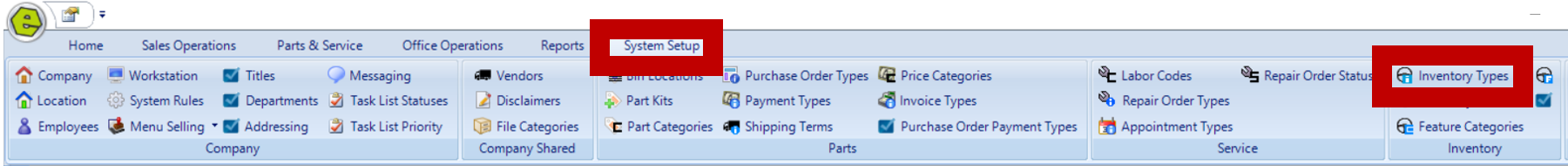

1. Navigate to System Setup Tab and select Inventory Types

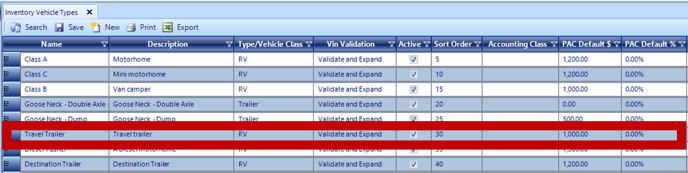

2. Click on the item line to adjust

3. Key the PAC Default $ & / or PAC Default %; percentage rate should be keyed as a decimal

4. Click OK

5. Save (PAC Defaults will need to saved separately on each Vehicle Type.)

NOTE: Setting the PAC Defaults will not automatically update on existing vehicles in inventory, manual adjustments will be required.

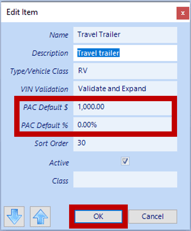

PAC Defaults can be set as either a percentage, a flat dollar amount or both, and can be tailored to the Vehicle Type, as shown below:

Example:

-

- Gooseneck Dump 2 has a PAC of 10%

- Travel Trailer has a PAC Flat Amount of $1,000.00

- Fifth Wheel has both, PAC Flat Amount $1500.00 plus an additional percentage 3%

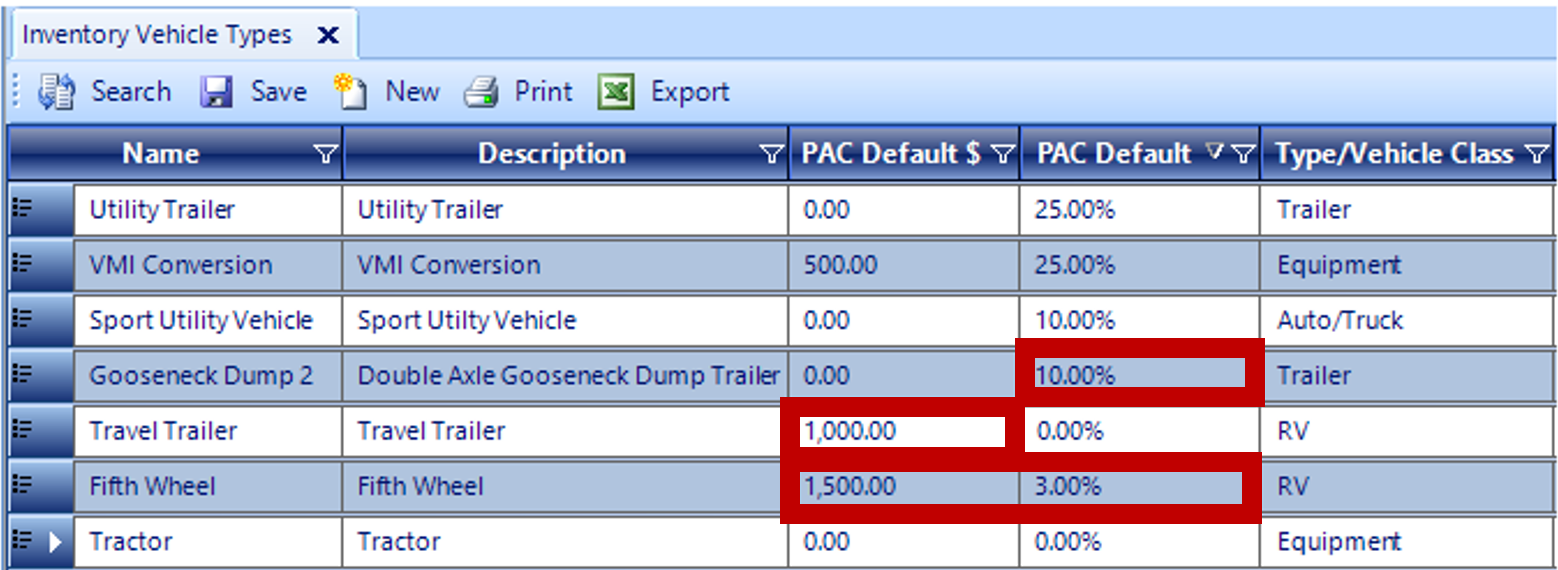

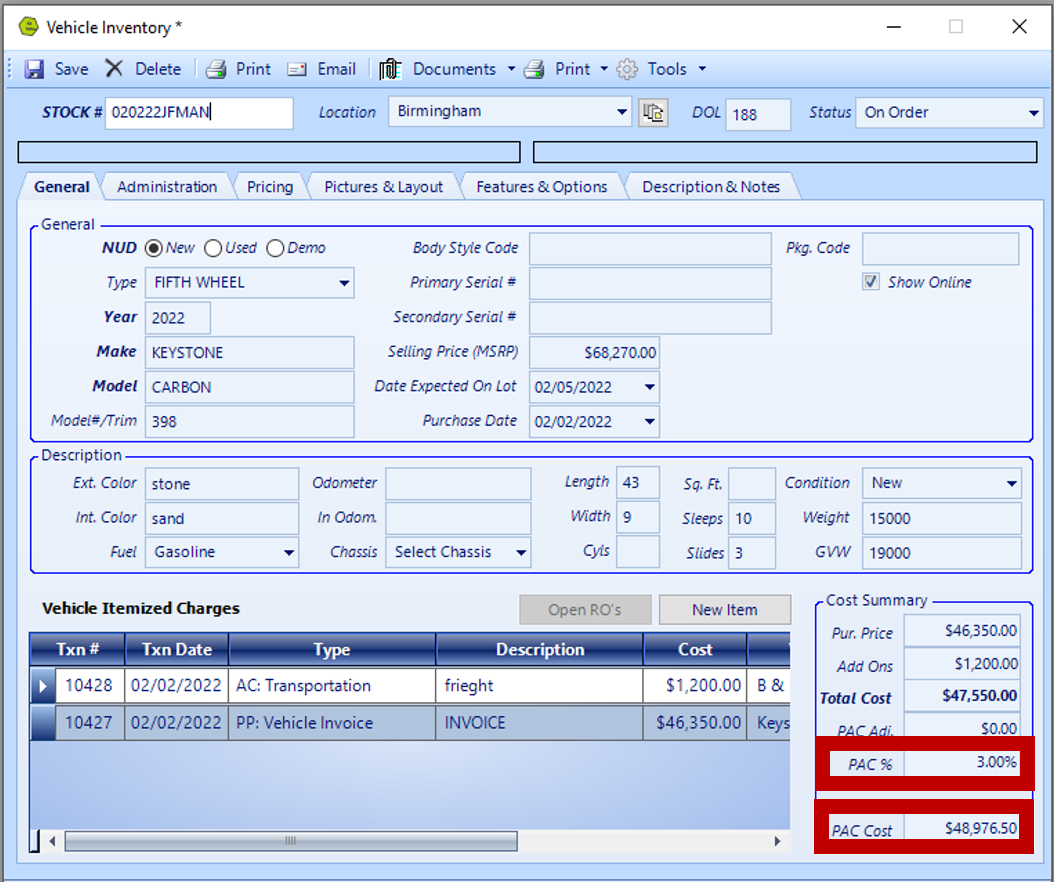

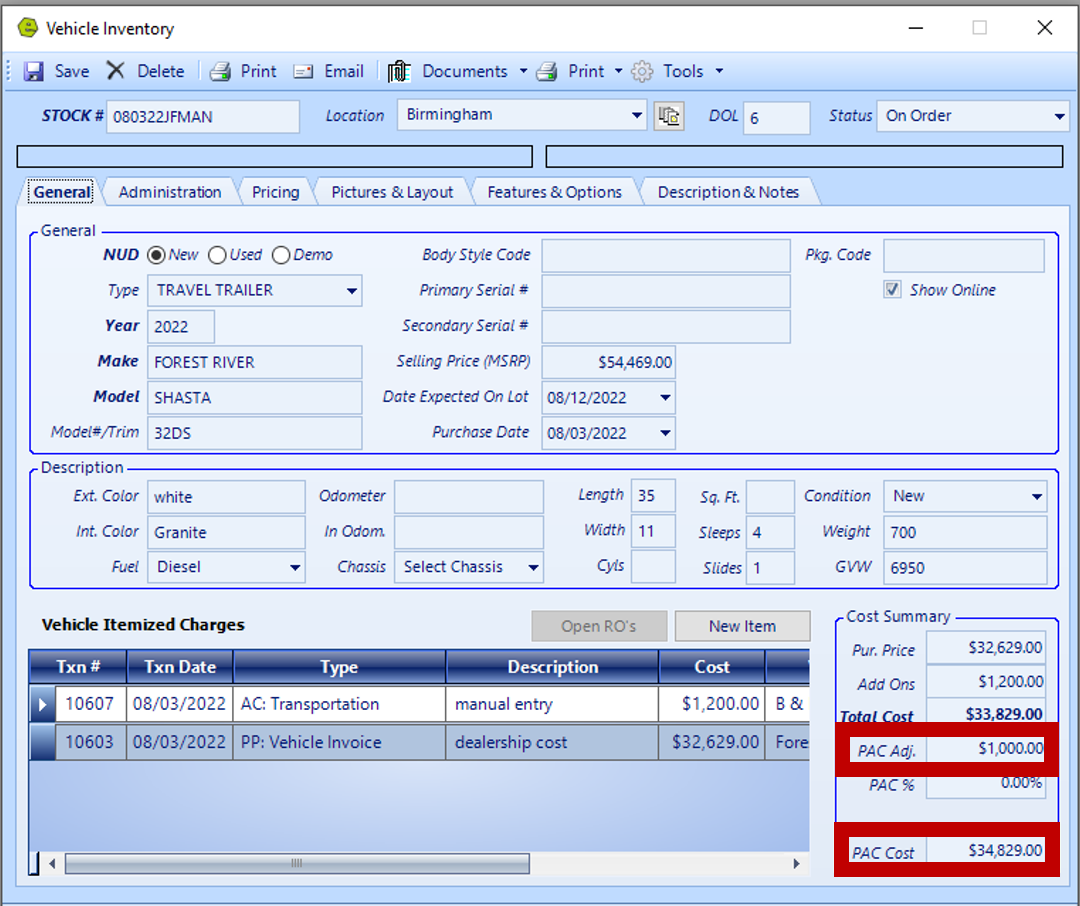

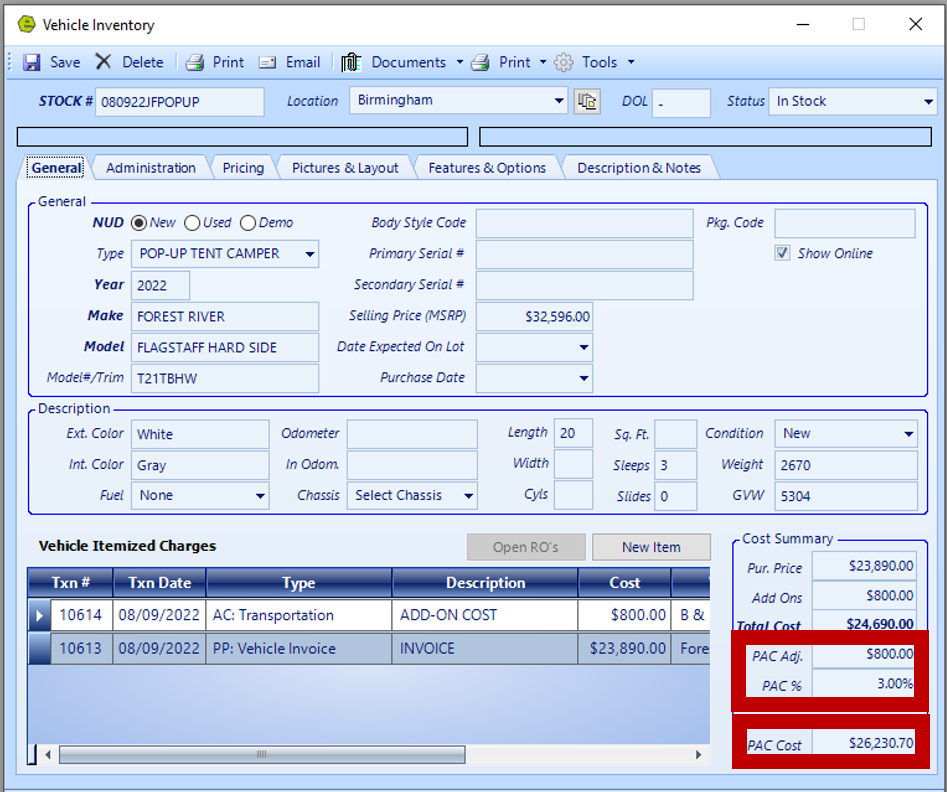

The examples below show how differing PAC Default Types effect the unit selling price:

PAC Percentage Rate

PAC Flat Dollar Amount

BOTH PAC Percentage Rate and PAC Flat Dollar Amount can be used at the same time and are cumulative. If both options are chosen the Percentage Rate is calculated on the unit cost, then the Flat Dollar Amount is added.

For additional information on vehicle inventory in EverLogic, check out this full-length course below:

Related Articles:

New Vehicle Purchase Order Form (Multi-Unit Ordering)

Mapping Vehicle Type in QuickBooks

Enter Floor Plan Balance on a Unit

How to Change the Floor Plan Starting Balance of Unit Inventory