Deal Posting for Third Party Finance Company that Provides F&I Services

When posting deal transactions and there is a Third Party F&I Company involved, there are a couple of things that need to be done. These things are necessary to make the transactions balance when it is sent to QuickBooks.

There are some terms to know when posting a Deal with a Third Party Finance Company that Provides F&I Services. The Dealer receives a commission for the financing of the vehicle purchase, this is often referenced as “Finance Reserve”. It is the interest rate differential between the “buy-rate” and the “sell-rate”. The “buy-rate” is the interest rate the finance company offers the Dealer. The “sell-rate” is the interest rate the Dealer offers the Customer. The Third Party F&I Company splits the profit with the Dealer based on their agreement; ie the “buy-rate” may be 5%, which is the profit the Dealer earns on securing the financing, with a Third Party Finance Company.

Two things are important when working with these transactions,

- “buy-rate” AKA “Finance Reserve”: Record the income the dealership makes when selling F&I Products

- “sell-rate”: Record the amount the dealership will pay the F&I company for handling the sale and processing of the transaction.

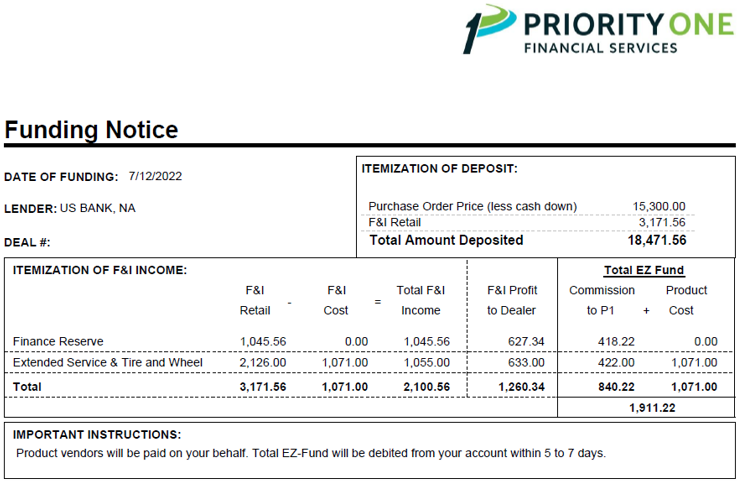

EXAMPLE: This is an example of a funding sheet provided by Priority One, AKA P1:

In this example, the dealer earns 60% of the profit and P1 receives 40% of the profit. The Finance Reserve is $1,045.56, from the Funding Notice. The Dealer’s profit is $627.34 and the P1 profit is $418.22. There is no cost associated with this portion of the transaction.

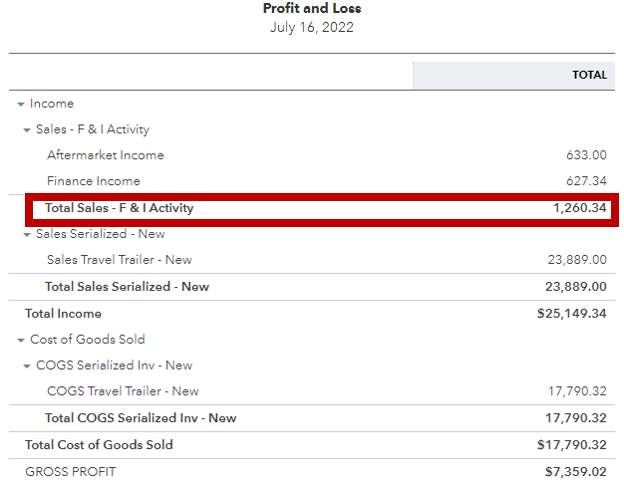

The Extended Service and Tire and Wheel products sold income is calculated by taking the amount the products were sold $2,126.00 and subtracting the cost of the products $1,071.00 which equals the profit earned, totaling $1,055.00. Based on the 60/40 split, the dealer earns $633.00 and P1 earns $422.00. One of the key figures is the cost of the F&I products, $1,071.00, which will be factored later. The Dealer earns a total profit of $627.34 + $633.00 = $1,260.34.

P1 earns a profit of $418.22 + $422.00 = $840.22. They also collect the cost of the Extended Service and Tire and Wheel products $1,055.00. This profit + cost is the amount that will be drafted from the Dealer’s bank account by P1 for providing F&I Services. In this example, the amount is $1,055.00 + $840.22 = $1,911.22.

The Dealer will be able to pay for these services out of the amount deposited by the finance company for the vehicle purchase less cash down; $15,300.00 and the finance products $3,171.56 for a total deposit of $18,471.56.

In EverLogic, it is important to record the income and expenses that will be incurred, during Profit Accounting. The Dealer’s income and the amount owed to P1 can be derived by entering the income and costs for the Finance Reserve and Aftermarket products, such as Extended Service and Tire and Wheel sold.

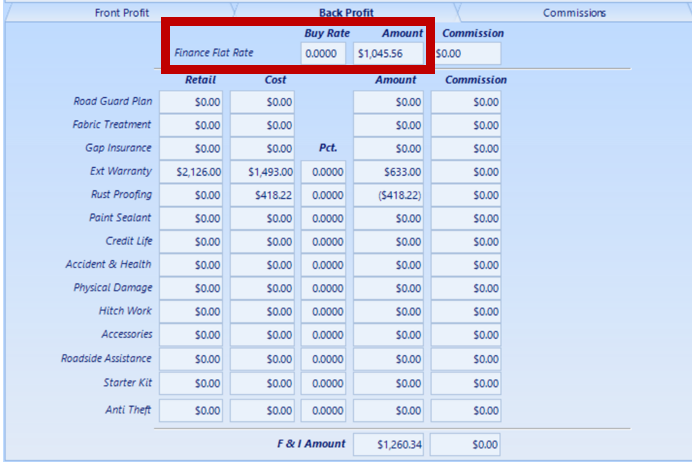

EXAMPLE: The example below is the Profit Accounting entries necessary to account for the income and expenses due to P1. Enter the Total F&I Income value amount of $1,045.56, from the P1 funding sheet, in the Finance Flat Rate Amount field.

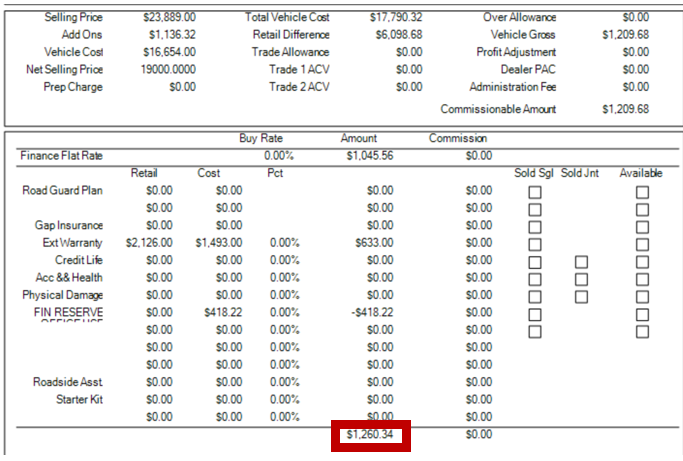

The Extended Service and Tire and Wheel products sold for $2,126.00 and this amount is carried forward from the Deal Form. To determine the cost of these products, it is important to add the cost of the products sold and the P1 commission earned. From the funding sheet, add the F&I cost of $1,071.00 and the P1 commission of $422.00 for a total of $1,493.00. Enter this in the Cost Field, it will calculate the Dealer’s profit of $633.00 which also matches the funding sheet.

IMPORTANT: Using another aftermarket product cost field like Rust Proofing you can manipulate the deal to account for the actual profit of the Finance Reserve and by subtracting the amount of the P1 commission earned. In this example, $418.22 which is the cost field for Rust Proofing. This will subtract $418.22 from the total Finance Reserve amount of $1,045.56. When all the amounts are totaled, the F&I amount on the Profit Accounting Form will equal the Dealer’s profit amount calculated on the funding sheet, in this example it is $1,260.34.

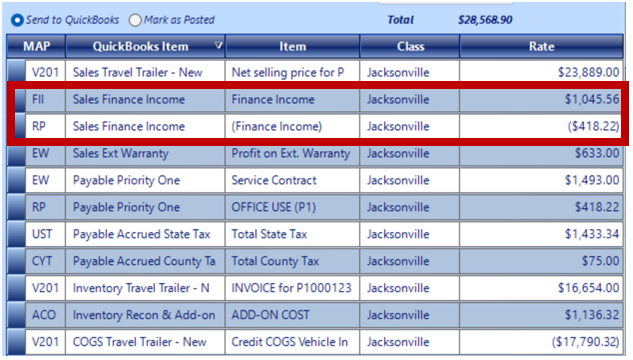

When the Deal is Washed, the transaction sent to QuickBooks will include the proper income earned and amount owed to P1.

Hint: Sort the list by QuickBooks Item, it is easier to read as like items are grouped together.

In the posting window, the Sales Finance Income 1,045.56 - 418.22 = 1,260.34 which is the same amount of profit earned on the P1 funding sheet.

The payable amount due to P1 is $1,493.00 + $418.22 = $1,911.22, which is the same amount of the Total EZ Fund, which will be drafted from the bank account within 5-7 days, based on the terms of the funding contract.

Balance Sheet Report in QuickBooks:

Related Articles:

Accepting / Refunding a Deposit on a Deal

Cancel Deal "Undo Sale & Restock" Inventory

More Than Three Trades to a Deal / Quote