This Inventory Tax is charged to the Dealer on a periodic basis by the state.

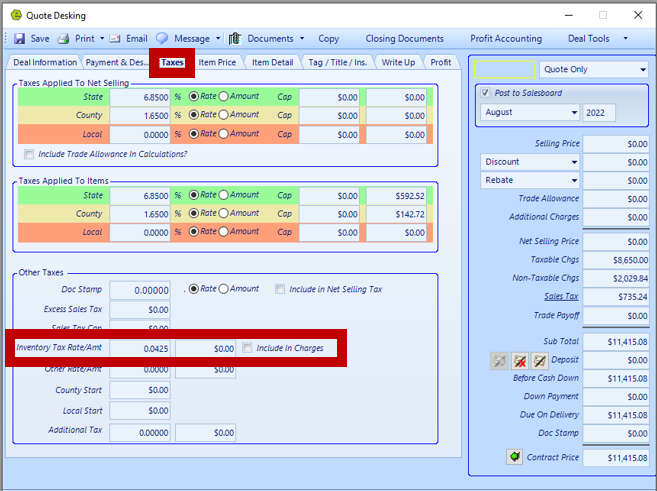

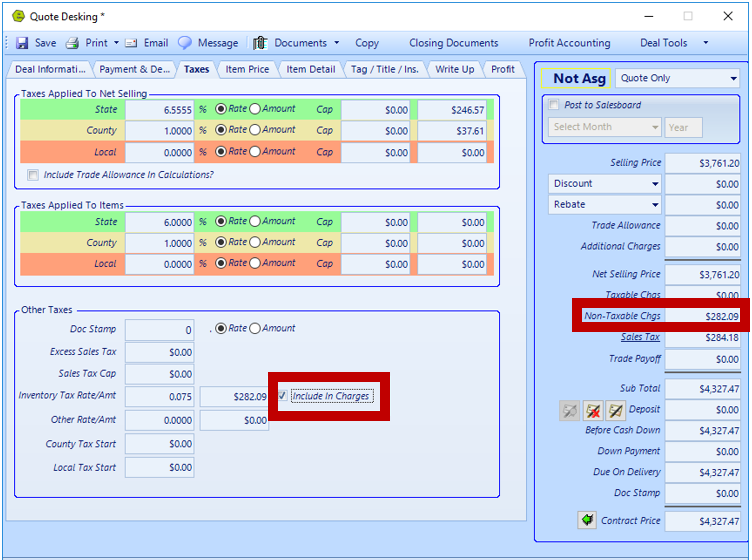

The Inventory Tax Field is located on the Taxes Tab, in the Other Taxes Section of the Deal Form.

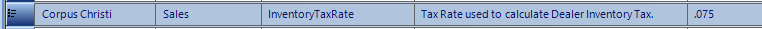

IMPORTANT: The tax rate used to compute the inventory tax is loaded in the InventoryTaxRate System Rule as a decimal value; ie 7.5% tax rate would be entered as .075 in the Rule.

REMINDER: Select a Location for the Rule, the Rule can be copied for multiple Locations.

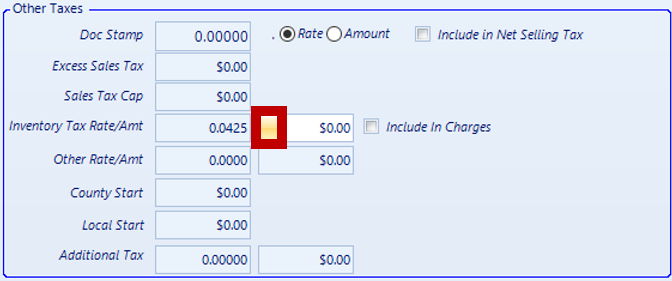

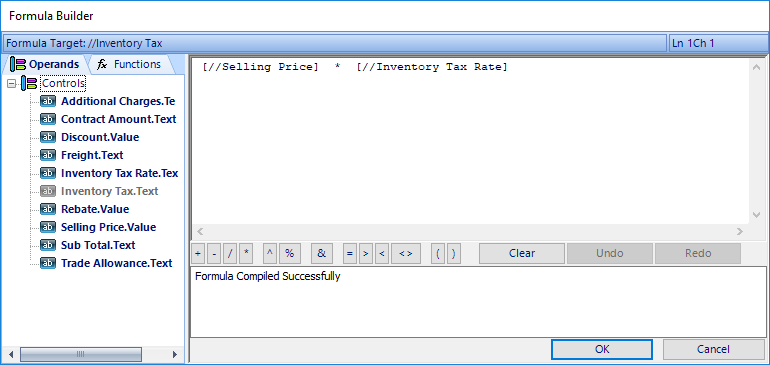

The Inventory Tax Rate / Amt Field is a computed by using a formula. Access Formula Builder Window by hovering over the left side of the amount field, a yellow button will appear and can be selected to launch the Formula Builder Window.

EXAMPLE: The formula in the will multiply the Selling Price (Not the Net Selling Price) of the vehicle times the tax rate entered in the System Rule and the result will be loaded to the Inventory Tax Field.

If the Dealer passes the tax on to the Customer, the user should select the Include in Charges Box. If selected, the computed amount of the inventory tax will be loaded to the Non-Taxable Chgs Field; shown below.

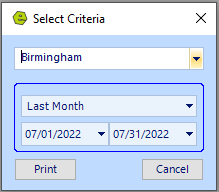

NOTE: There is an Inventory Taxes Report located on the Reports Tab, to compute the inventory tax due for a specified period. The tax is computed on all inventory units and the report shows the amount due regardless of whether the Customer paid the tax as part of the unit sale or the Dealer is paying the tax out of pocket.

Related Articles:

Setup Deal Defaults By Location or Dealership