List Unposted Curtailments / Interest pulls information directly from EverLogic, mapping is required.

NOTE: Be sure to Enter Floor Plan Balance on a Unit and post to QuickBooks before completing List Unposted Curtailments / Interest. Mapping is also required to complete the List Unposted Curtailments / Interest Process.

Set Map Codes

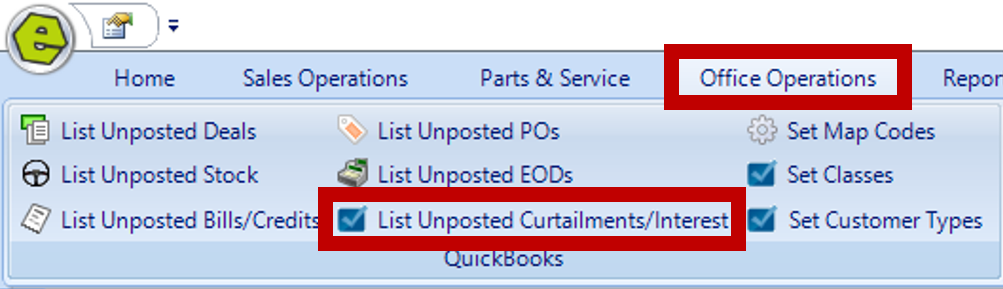

1. Navigate to the Office Operations Tab and select Set Map Codes

2. Locate the Map Codes below and map them accordingly

A. INT (Inventory Interest Expense Account) = map QuickBooks Item to an Expense Account in QuickBooks

B. CAP (Curtailment AP Account) = map to Accounts Payable - Floorplan

C. IAP (Inventory AP Account) = map to Accounts Payable - Floorplan

D. NAP (Interest AP Account) = map to Accounts Payable

REMINDER: Be sure to Enter Floor Plan Balance on a Unit and post to QuickBooks before completing List Unposted Curtailments / Interest.

List Unposted Curtailments / Interest

1. Navigate to the Office Operations Tab and select List Unposted Curtailments / Interest

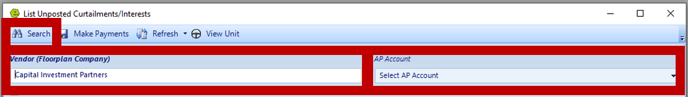

2. Choose a Vendor or AP Account

NOTE: The Vendor List that pulls on the List Unposted Curtailments / Interests is pulled from QuickBooks, so if the Vendor is not listed in QuickBooks they will not show in the drop down menu.

3. Click Search

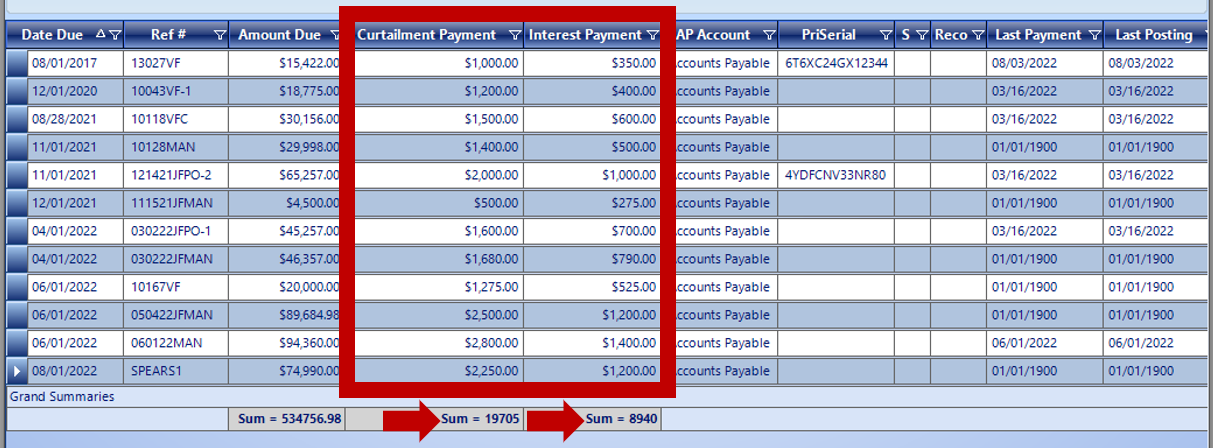

4. Key the Curtailment and Interest amount(s)

4. Key the Curtailment and Interest amount(s)

NOTE: Vehicles / Unit will not show it they have not been posted in QuickBooks. Totals will be calculated in the Sum Box, at the bottom of the column.

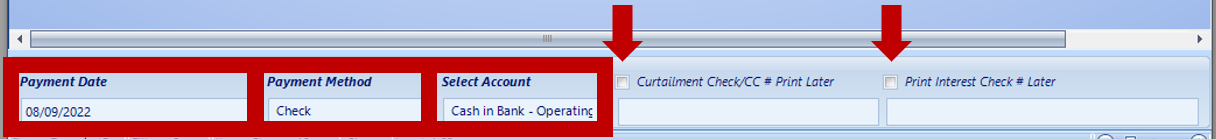

5. Select the Payment Date

6. Select Payment Method

7. Select Account

NOTE: If you plan to write a physical check, check the box next to Curtailment Check / CC # and Print Interest Check. If you're paying via ACH, leave the boxes unchecked and type ACH in the space provided.

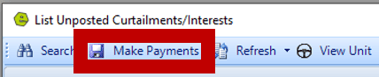

8. Click Make Payments

NOTE: In QuickBooks, there will be a separate check for the Curtailment Payments and the Interest Payments. The memo will include the Stock Number of units included in the payments.

EXAMPLE

-

- Curtailment Payment = $2000

- Interest Payment = $800

-

- Curtailment Payment will only generate a Bill Payment of $2000 in QuickBooks, and will be applied to the Bill created for the unit. The Bill will show the date the Itemized Charge for Vehicle Invoice was entered on the Vehicle Inventory Form.

- Interest Payment will generate a Bill of $800 and a Bill Payment of -$800 in QuickBooks.

Related Articles:

How to Change the Floor Plan Starting Balance of Unit Inventory

Correcting Curtailment Payment Keyed as a Negative Amount

New Vehicle Purchase Order Form (Multi-Unit Ordering)

Adding PAC as a Default to Vehicles

Mapping Vehicle Type in QuickBooks